Governance policies for a bio-based blue economy

A bio-based blue economy aims to optimize the sustainable development and utilization of natural coastal and marine resources for the benefit of society in a market context. Natural resources that benefit to society are also called ecosystem services, see Ecosystem services for an introduction.

Contents

Pricing of ecosystem services

A free market economy does not guarantee that optimal benefits are derived from natural resources[1]. Market mechanisms can contribute to sustainable development and enhanced benefits from natural assets (e.g. a private fish pond) protected by exclusive property or user rights. However, most natural resources are publicly owned and can be used freely. Without government intervention, they run the risk of either being underdeveloped (e.g. littered beach, degraded water quality) or compromised by overexploitation (e.g. depletion of wild fish stocks, seafront development that accelerates erosion), see the 'Tragedy of the Commons'.

Public intervention is also necessary when the market price of products of the blue economy does not take into account the social costs of negative side effects on the environment. These unpriced side effects of economic activities that may degrade the potential benefits of ecosystem services are called externalities; externalities can be positive, but more often they are negative. Pollution and habitat degradation are examples of negative externalities. Habitat diversification by offshore structures (e.g. wind farms) can be considered an example of a positive externality. Evaluating the net social impact of the blue economy on the coastal and marine environment is not always straightforward, as impacting activities generally have beneficial effects on some environmental aspects and detrimental effects on others. Several methods have been developed to set a price on the benefits derived from coastal and marine resources, see e.g. Multifunctionality and Valuation in coastal zones: concepts, approaches, tools and case studies and other articles in the category Evaluation and assessment in coastal management. Although there is no unique unambiguous method, we will assume here that it is in general possible to assess whether the net societal effect of externalities is beneficial or detrimental.

Blue economy product categories

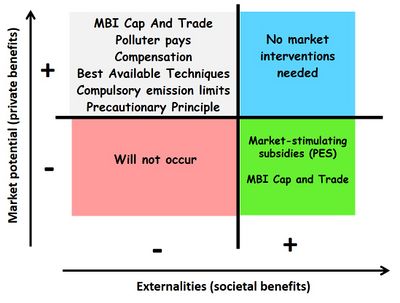

The type of intervention that is most appropriate and effective to optimize the social benefits that can be derived from natural resources depends on the resource and the valuation by society. A framework of market-based strategies has been elaborated by Hasselström and Gröndahl (2021)[2] for eutrophication reduction and carbon storage issues. These strategies can also be applied in the more general context of natural resource optimization. They distinguish four product categories based on market value [math]M[/math], production costs [math]P[/math] and externalities [math]E[/math]. The sum of beneficial and detrimental externalities (net societal impact) can be positive or negative. The four product categories, illustrated with some examples, are:

- [math]E\gt 0, \quad M\gt P . \quad[/math] Positive net societal impact, market value exceeds production costs

Examples (only positive externalities indicated):

M = Beach tourism, P = Investments in infrastructure, beach nourishment and sewage treatment, E = Coastal protection, ecosystem health

M = Seafood, P = Mollusc farms in eutrophic waters, E = Reduction of excess nutrients

M = Medical applications, P = Seaweed farming, E = Reduction of excess nutrients

M = Flood protection, P = Restoration of mangrove forests, E = contribution to carbon sequestration and other ecosystem services - [math]E\lt 0, \quad M\gt P . \quad[/math] Negative net societal impact, market value exceeds production costs

Examples (only negative externalities indicated):

M = Seafood, P = Fish fleet, E = Foodweb disturbance (e.g. trophic cascade effects), habitat degradation / loss, biodiversity loss and species extinction (see Effects of fisheries on marine biodiversity)

M = Coastal tourism, P = Real estate development, E = Habitat degradation, landscape alteration

M = Shipping, P = Canalization of estuaries, E = Loss of habitats and associated ecosystem functionalities - [math]E\gt 0, \quad M\lt P. \quad[/math] Positive net societal impact, market value lower than production costs

Examples (only positive externalities indicated):

M = Food provision, P = Harvesting invasive species (e.g. jellyfish), E = Foodweb restoration

M = Renewable energy, P = Biomass of seaweed cultivation, E = Carbon sequestration, biofertilizer and other ecosystem services (see Seaweed (macro-algae) ecosystem services)

M = Non-marketable services, e.g. water quality, landscape, P = restoration coastal wetlands, E = contribution to carbon sequestration, biodiversity and other ecosystem services - [math]E\lt 0, \quad M\lt P . [/math] Negative net societal impact, market value lower than production costs

No market potential.

Policy instruments for a bio-based blue economy

Categories 1 and 4 do not require government intervention in principle. Category 1 projects normally take place in a liberal market and produce net beneficial side effects for society. The positive externalities (ecosystem services) can in some cases be enhanced by government subsidies. Subsidies should be carefully targeted to avoid the risk that government money is spent on services that would be provided anyway[2]. Net social benefits can also be enhanced by limiting any harmful side-effects. One example is the issuing of labels that guarantee that products have been produced without harming the environment. Such labels, so-called eco-certification, are a market-based instrument that may convince consumers to pay a higher price, as producers take all necessary measures to prevent their activities from harming the environment[3].

Category 4 will not happen in a liberal market economy.

Category 2 projects will normally occur in a liberal market economy, but the negative side effects may be considered socially unacceptable. Several types of governmental intervention can address this issue:

- Setting legally binding and enforceable limits on the production of negative side effects or the obligation to completely phasing out certain negative side effects. Such interventions are in line with the Precautionary Principle. Although emission standards for polluting substances exist in many countries, enforcement is often insufficient to ensure full compliance[4].

- Obligation to apply the Best Available Techiques (BAT) or Best Available Techniques Not Entailing Excessive Costs (BATNEEC). BAT and BATNEEC are key elements of environmental laws in many countries around the world, especially for setting emission limit values or imposing other permit conditions to prevent or control industrial emissions[5].

- Compensatory measures. Under EU law, actors carrying out activities that cause harm to protected species or protected habitats that cannot reasonably be avoided are obliged to take measures that compensate for these environmental adverse effects.

- The polluter pays principle (PPP). Producers are obliged to pay a tax or penalty for repairing any damage caused to the environment. This principle, when applied to activities that interfere with natural resources, generates a strong incentive for actors to mitigate negative side effects or switch to more environmentally friendly production processes. The PPP can be extended to include assurance or performance bonds, which are an economic instrument to ensure that the worst case cost of damage is covered. Assurance premiums provide an incentive to limit impacts and to repair any damage the activity has produced. For example, lower insurance costs for the use of more environmentally friendly fishing gear provide an incentive for their earlier adoption and development[6].

- Market-Based Instruments (MBI). The most commonly applied MBI to reduce environmental damage is CAT - Cap and Trade (not to be confused with Common Asset Trust). CAT is based on tradable permits that allow companies to cause a limited amount of environmental damage over a certain period of time (e.g. allowances to emit greenhouse gases). CAT encourages actors to take mitigation measures and sell permits that are no longer needed, so that emissions can be allocated where mitigation measures are most costly. Reduction of environmental damage is achieved by progressively limiting the number of allowances available in the market. Ensuring that actors do not exceed their allowances is crucial for the credibility of the CAT mechanism and requires rigorous monitoring and validation. In practice, CAT is implemented to reduce CO2 emissions through the so-called Emission Trading System (ETS). Companies that are classified as large emitters of greenhouse gases are required to purchase a quantity of carbon credits corresponding to their emissions. These credits are traded on the so-called 'compliance carbon market', where the amount of available credits per country is determined on the basis of internationally agreed emission reduction targets.

In the fishing industry, tradable fishing rights are referred to as Individually Transferable Quotas (ITQ), the right to harvest a certain proportion of the total allowable catch (TAC). ITQs represent catch shares which are transferable; shareholders have the freedom to buy, sell and lease quota shares according to their needs. The economic value of quota shares varies in proportion to the total allowable catch and increases when fish stocks are well managed. ITQ shares therefore create an economic incentive for environmental stewardship. However, ITQs do not exclude 'free-riding' behavior[7].

Other applications of CAT to reduce the negative externalities of economic activities are conceivable. In the Netherlands, for example, the reduction of nitrate emissions from livestock farming is promoted through a system of tradable manure quotas[8].

Category 3 projects will not normally be taken up in a liberal market economy, even if they provide significant societal benefits. Financial support is needed to make these projects economically viable. Instruments are:

- PES - Payment for Ecosystem Services. Public subsidies (PES) can provide incentives for companies to develop additional ecosystem services, provided that the financial compensation can make the activity economically viable. In some cases, PES subsidies can also be awarded by private parties if the activity generates externalities that benefit their company. PES subsidies are conditional on the delivery of agreed ecosystem services and may not exceed the value of the ecosystem services delivered[9]. PES differs from public-private partnership in that the subsidized ecosystem service provides benefits to society at large and not exclusive exploitation rights.

- CAT - Cap and Trade. Projects that contribute to mitigating environmental degradation or to restoring degraded ecosystems can be (co)financed through the sale of allowances that offset environmental damage caused by other economic actors. This requires the existence or the creation of a CAT market where such allowances can be sold and bought. Such a market exists for compensating greenhouse gas emissions. Several international organizations (the most ancient being Verra) have established widely accepted verified carbon standards for certifying the amount of carbon sequestered by blue carbon projects, according to principles established by the UNFCC. These organizations provide certified credits for local blue carbon projects that enhance carbon sequestration in coastal wetlands, e.g. mangrove forests, salt marshes, seagrass meadows (see Blue carbon sequestration). Certified blue carbon projects can be funded by governments to meet national targets for reducing greenhouse gas emissions, according to the Joint Implementation (JI) and Clean Development Mechanism (CDM) of the Kyoto Protocol and article 6 of the Paris Agreement. Blue carbon projects can also be (co-)financed by selling certified carbon credits to companies that are willing (but not forced under the compliance regime) to compensate for the impact of their greenhouse gas emissions. An international voluntary market has been created for the trading of certified carbon credits. However, the market price of carbon credits on the voluntary market is much lower then the price of carbon credits on the compliance market. Moreover, the high costs associated with labor-intensive carbon measurement and monitoring for blue carbon certification are a concern for small-scale projects, which may therefore be better off relying on PES financing or other financing schemes[10]. Limited knowledge about the mechanisms, classification form and investment models of blue carbon finance is seen as another impediment for blue carbon projects[11]. Currently, the potential of blue carbon financing for coastal wetland construction, conservation and maintenance remains largely untapped[12]. Increase of the market price of carbon credits on the voluntary market would provide a strong stimulus for blue carbon projects[13]. Guidance for blue carbon projects on technical, organizational and financial aspects is provided in the blue carbon handbook commissioned by the high level panel for a sustainable ocean economy[14].

A blue bio-based economy would also be boosted by the establishment of an international trading system for nutrient offset credits. In this way, financial resources could be raised for the restoration and maintenance of coastal habitats that provide other ecosystem services in addition to eutrophication mitigation. Currently (2022) there are few initiatives to develop market-based tools for nutrient offsetting and other ecosystem services in coastal areas[2].

Governance policies fostering a blue bio-economy discussed in this article are summarized in Fig. 1.

Related articles

- Blue carbon sequestration

- Ecosystem services

- Multifunctionality and Valuation in coastal zones: concepts, approaches, tools and case studies

- Seaweed (macro-algae) ecosystem services

References

- ↑ Austen, M.C., Andersen, P., Armstrong, C., Döring, R., Hynes, S., Levrel, H., Oinonen, S., and Ressurreiçao, A. 2019. Valuing marine ecosystems - taking into account the value of ecosystem benefits in the blue economy. In: Future Science Brief 5 of the European Marine Board. Ostend, Belgium, ISBN 9789492043696. ISSN: 4920-43696

- ↑ 2.0 2.1 2.2 2.3 Hasselström, L. and Gröndahl, F. 2021 Payments for nutrient uptake in the blue bioeconomy – When to be careful and when to go for it. Marine Pollution Bulletin 167, 112321

- ↑ Froger, G., Boisvert, V., Méral, P., Le Coq, J-F., Caron, A. and Aznar, O. 2015. Market-Based Instruments for Ecosystem Services between Discourse and Reality: An Economic and Narrative Analysis. Sustainability 2015, 7, 11595-11611

- ↑ Giles, C. 2020. Next Generation Compliance: Environmental Regulation for the Modern Era Part 2: Noncompliance with Environmental Rules Is Worse Than You Think. Harvard Law School, Environmental And Energy Law Progam

- ↑ OECD 2017. Report on OECD project on best available techniques for preventing and controlling industrial chemical pollution activity: policies on BAT or similar concepts across the world. Health and Safety Publications Series on Risk Management No. 40 ENV/JM/MONO(2017)12

- ↑ Innes, J., Pascoe, S., Wilcox, C., Jennings, S. and Paredes, S. 2015. Mitigating undesirable impacts in the marine environment: a review of market-based management measures. Front.Mar.Sci. 2:76

- ↑ Garrity, E.J. 2020. Individual Transferable Quotas (ITQ), Rebuilding Fisheries and Short-Termism: How Biased Reasoning Impacts Management. Systems 2020, 8, 7

- ↑ Wossink, A. 2004. The Dutch Nutrient Quota System: Past Experience and Lessons for the Future. In: T. Tietenberg and N. Johnstone (Editors), Tradeable Permits: Policy Evaluation, Design and Reform, OECD, Paris, pp. 99-120

- ↑ Wunder, S. 2015. Revisiting the concept of payments for environmental services. Ecological Economics 117: 234-243

- ↑ Friess, D.A., Howard, J., Huxham, M., Macreadie, P.I. and Ross, F. 2022. Capitalizing on the global financial interest in blue carbon. PLOS Clim 1(8): e0000061

- ↑ Li, P. and Liu, D. 2025. How blue carbon financing can sustain blue carbon ecosystems protection and restoration: A proposed conceptual framework for the blue carbon financing mechanism. Ocean and Coastal Management 265, 107644

- ↑ Macreadie, P.I. et al. 2022. Operationalizing marketable blue carbon. One Earth 5: 485-492

- ↑ Zeng, Y., Friess, D.A., Sarira, T.V., Siman, K. and Koh, L.O. 2021. Current Biology 31: 1–7

- ↑ Schindler Murray, L. and Milligan, B. (lead coordinating authors) 2023. The blue carbon handbook: Blue carbon as a nature-based solution for climate action and sustainable development. Report. London: High Level Panel for a Sustainable Ocean Economy.

Please note that others may also have edited the contents of this article.

|