Difference between revisions of "Socio-economic evaluation"

Dronkers J (talk | contribs) |

Dronkers J (talk | contribs) |

||

| (8 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| + | |||

| + | |||

==Introduction== | ==Introduction== | ||

| − | [[Image:builddecision.jpg|thumb|right| | + | |

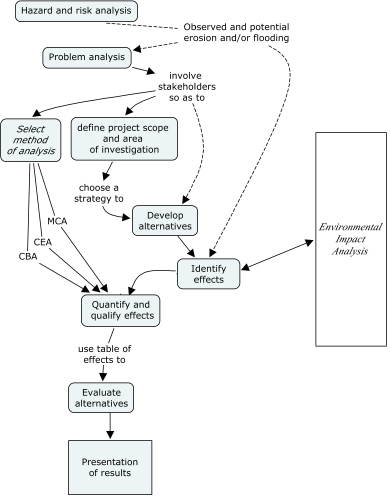

| − | The overall objective of socio-economic evaluation is to maximize the benefits of future investments in | + | [[Image:builddecision.jpg|thumb|400px|right|Figure 1. Generic flowchart for coastal project evaluation]] |

| + | |||

| + | The overall objective of socio-economic evaluation is to maximize the benefits of future investments in coastal management in a sound and sustainable way ([[ICZM]]). Various forms of socio-economic evaluation are used to assist in Coastal Management and making decisions regarding the coastal zone. | ||

Any evaluation must have a starting point and purpose. In the case of coastal erosion projects knowledge is needed on "Monitoring and modeling the shoreline", "Engineering the shoreline", "Integrating the shoreline into spatial planning policies" and "Valuating the shoreline". Evaluation can be done in different phases of a project - "ex-ante", "in medias res" or "ex-post" (before, while or after a project is carried out". Regardless which phase of a project the same methods are applied. The steps of an evaluation is shown in the flowchart of Figure 1. | Any evaluation must have a starting point and purpose. In the case of coastal erosion projects knowledge is needed on "Monitoring and modeling the shoreline", "Engineering the shoreline", "Integrating the shoreline into spatial planning policies" and "Valuating the shoreline". Evaluation can be done in different phases of a project - "ex-ante", "in medias res" or "ex-post" (before, while or after a project is carried out". Regardless which phase of a project the same methods are applied. The steps of an evaluation is shown in the flowchart of Figure 1. | ||

==Main methods of analysis== | ==Main methods of analysis== | ||

| − | There are three basic forms or analysis. They all have a common starting step and that is the "Table of effects" listing all effects relevant to the evaluation for all alternatives evaluated. | + | There are three basic forms or analysis <ref>Boardman, A., Greenberg, D., Vining, A. and Weimer, D. 2018. Cost-Benefit Analysis – Concepts and Practice, Fourth edition, Cambridge University Press. https://students.aiu.edu/submissions/profiles/resources/onlineBook/E5V5H3_Cost-benefit%20analysis%20_%202018.pdf </ref><ref>EU 2015. Guide to Cost-Benefit Analysis of Investment Projects Economic appraisal tool for Cohesion Policy 2014-2020. European Commission DG for Regional and Urban policy https://ec.europa.eu/regional_policy/sources/studies/cba_guide.pdf</ref>. They all have a common starting step and that is the "Table of effects" listing all effects relevant to the evaluation for all alternatives evaluated. |

| − | * Cost-Benefit Analysis (CBA) | + | * Cost-Benefit Analysis (CBA) |

* Cost-Effectiveness Analysis (CEA) | * Cost-Effectiveness Analysis (CEA) | ||

* Multi-Criteria Analysis (MCA) | * Multi-Criteria Analysis (MCA) | ||

===Cost-Benefit Analysis (CBA)=== | ===Cost-Benefit Analysis (CBA)=== | ||

| − | The ''Cost-Benefit Analysis'' is an evaluation method that gives an overview of the advantages and disadvantages of project alternatives or measures in terms of social welfare. These advantages and disadvantages are presented in the form of cost items and benefit items on a cost-benefit balance sheet. The items are expressed in terms of money (“monetised”) | + | The ''Cost-Benefit Analysis'' is an evaluation method that gives an overview of the advantages and disadvantages of project alternatives or measures in terms of social welfare. These advantages and disadvantages are presented in the form of cost items and benefit items on a cost-benefit balance sheet. The items are expressed in terms of money (“monetised”) to enable the various project alternatives to be compared. The main question in a Cost Benefit Analysis is “Do the benefits outweigh the costs?”. The welfare effect is expressed in the balance of all costs and benefits. The costs and benefits of alternatives can also be compared to determine which alternative is preferable. |

===Cost-Effectiveness Analysis (CEA)=== | ===Cost-Effectiveness Analysis (CEA)=== | ||

| Line 19: | Line 23: | ||

===Multi-Criteria Analysis (MCA)=== | ===Multi-Criteria Analysis (MCA)=== | ||

| − | A ''Multi-Criteria Analysis'' give a decision-maker the opportunity to weigh a wide range of different effects against each other in the decision-making process. MCA methods can be used to get large quantities of dissimilar information into a manageable form for decision-making. A MCA produces a “weighted sum” of the project’s effects. For each project alternative, a number of criteria are used to give a weighing to each of the effects considered. The weightings determine how significant an effect is in the project alternative’s overall score. | + | A ''Multi-Criteria Analysis'' give a decision-maker the opportunity to weigh a wide range of different effects against each other in the decision-making process. MCA methods can be used to get large quantities of dissimilar information into a manageable form for decision-making. A MCA produces a “weighted sum” of the project’s effects. For each project alternative, a number of criteria are used to give a weighing to each of the effects considered. The weightings determine how significant an effect is in the project alternative’s overall score. Valuation criteria are not expressed exclusively in money. An assessment grade can be given to criteria for which a good monetary estimate is not possible. In a first step, all scores, both monetary and non-monetary rating grades, are normalized so that the best scoring option on a given criterion receives a 1, while other options receive a proportionately lower score. In a second step, weights are assigned to all criteria, by which the normalized scores are multiplied. By adding the results together, the various alternatives are ranked in order of preference based on overall scores. The crucial step in MCA is determining the weights of the criteria. Weights can be determined for example through expert judgment and/or stakeholder consultation. |

==Methods for valuation of effects== | ==Methods for valuation of effects== | ||

| − | * Travel Cost Method (TCM) | + | Several methods have been developed to identify and estimate the effects of investments, in terms of socio-economic costs and benefits. Some of these methods are described in more detail in other Coastal Wiki articles. |

| − | + | ||

| − | * Contingent Valuation Method (CVM) | + | * The Travel Cost Method primarily measures the recreational value that visitors place on particular recreation areas (parks, beaches, woodland etc.). It is assumed that the costs in terms of time and transportation that an individual incurs in visiting a site reflect the person’s appreciation of that site. The basic principle is that people only visit an area if the expected benefits exceed the costs incurred. The costs incurred are then taken as an indicator of the benefits (recreational values). TCM is a useful method to assess recreational benefits. Travel costs are related to distance and can only capture part of the total value of nature (recreation). See [[Travel cost method]]. |

| − | * | + | |

| − | + | * The Contingent Valuation Method (CVM) assumes that people have preferences in relation to all goods, and therefore also in relation to goods that are not available on an existing market. The aim of a CVM study is to reveal these hidden preferences by means of questionnaires. People are asked the maximum amount of money they are willing to pay (or willing to accept as compensation) for a hypothetical change of a good. It is assumed that this professed willingness would equate to real willingness if a real market for the good did exist. Only the Contingent Valuation Method can capture both use and non-use values. However, the surveys have to be carefully designed. See [[Contingent Valuation Method]]. | |

| − | + | ||

| − | + | * The Hedonic Pricing Method relates differences in property prices (house and land prices) to variables in the surrounding environment. The basic principle is that property prices are affected to some extent by the characteristics of a particular environment effect. The environment effect can then be given a price tag based on house prices. An environment effect can be seen as positive (proximity to a recreational area, nice view) or negative (water pollution, risk of flooding). It may be to do with differences in time (time series data: prices in 1970 compared to prices in 2005 related to a change in the environment effect). It is also possible to analyse differences between areas with the same type of property but with one important difference in environment variable (cross-section data: the same type of housing in comparable environments with and without the environment effect). See [[Hedonic Evaluation Approach]] and [[Values of amenities in coastal zones]]. | |

| − | + | * The Prevention Cost Method is based on the prevention expenditure incurred by households, companies or governments to mitigate or avoid particular environmental risks or effects. Examples include the cost of sound insulation (double-glazing, noise barriers) to prevent or reduce excessive noise, or the cost of dikes to prevent flooding. People will only incur this prevention expenditure if the expected usefulness of the expenditure is greater than the expected inconvenience created by the environment effect. Willingness to incur this expenditure is an indication of the minimum cost of the effect or of the minimum benefit of mitigation of the effect. | |

| − | The | ||

| − | + | * The Production Factor Method rates changes in the productivity of natural or man-made systems as a result of a change in the environment. An example is the reduction in fish catch as a result of deterioration in water quality caused by a factory not cleaning its wastewater sufficiently before discharging it into the river. If the relationship between the water quality (dose) and the fish catch (response) is known, the value of deterioration in water quality can be calculated. The changes to the financial return of production (the fish catch) can be translated through the dose/response relationship into a counter value for the environment effect (the water quality). | |

| − | |||

| − | + | * The Benefit (or Value) Transfer Method, estimates of the benefits of nature and the environment from earlier studies are taken as an indication of the economic value of the benefits of nature and the environment in a new, similar policy context. See [[Value Transfer]]. | |

| − | |||

| − | + | * The Restoration Cost Method calculates the cost of measures required restoring or compensating for deterioration in or loss of nature and environment as a result of a project. This is also referred to as the Shadow Project Method. The method estimates the cost of specific measures designed to restore or compensate for deterioration in or loss of nature and environment. | |

| − | |||

| − | + | *Bequest value measures the willingness of individuals to pay for maintaining or preserving an asset or resource that has no use now, so that it is available for future. See [[Non-use value: bequest value and existence value]] | |

| − | + | ||

| + | *Existence value measure the willingness for individuals to pay for the sense of well being, of simply knowing that coastal zones are preserved. | ||

| − | |||

| − | |||

| − | |||

| − | |||

==References== | ==References== | ||

| − | + | <references/> | |

| − | + | ||

| − | |||

| − | |||

| − | |||

==See also== | ==See also== | ||

===Internal Links=== | ===Internal Links=== | ||

| + | :[[Total Economic Value]] | ||

| + | :[[Travel cost method]] | ||

| + | :[[Contingent Valuation Method]] | ||

| + | :[[Hedonic Evaluation Approach]] | ||

| + | :[[Value Transfer]] | ||

| + | :[[Economic Value]] | ||

| + | :[[Economic valuation of goods and services of the UK coastal and marine ecosystem]] | ||

| + | :[[Non-use value: bequest value and existence value]] | ||

| + | :[[Values of amenities in coastal zones]] | ||

| + | :[[Multifunctionality and Valuation in coastal zones: concepts, approaches, tools and case studies]] | ||

| + | :[[Multifunctionality and Valuation in coastal zones: introduction]] | ||

| + | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

{{author | {{author | ||

| Line 73: | Line 74: | ||

|AuthorName=Persson, Mats | |AuthorName=Persson, Mats | ||

|AuthorFullName= Persson, Mats}} | |AuthorFullName= Persson, Mats}} | ||

| + | |||

| + | [[Category:Evaluation and assessment in coastal management]] | ||

| + | [[Category:Integrated coastal zone management]] | ||

Latest revision as of 17:38, 3 March 2024

Contents

Introduction

The overall objective of socio-economic evaluation is to maximize the benefits of future investments in coastal management in a sound and sustainable way (ICZM). Various forms of socio-economic evaluation are used to assist in Coastal Management and making decisions regarding the coastal zone.

Any evaluation must have a starting point and purpose. In the case of coastal erosion projects knowledge is needed on "Monitoring and modeling the shoreline", "Engineering the shoreline", "Integrating the shoreline into spatial planning policies" and "Valuating the shoreline". Evaluation can be done in different phases of a project - "ex-ante", "in medias res" or "ex-post" (before, while or after a project is carried out". Regardless which phase of a project the same methods are applied. The steps of an evaluation is shown in the flowchart of Figure 1.

Main methods of analysis

There are three basic forms or analysis [1][2]. They all have a common starting step and that is the "Table of effects" listing all effects relevant to the evaluation for all alternatives evaluated.

- Cost-Benefit Analysis (CBA)

- Cost-Effectiveness Analysis (CEA)

- Multi-Criteria Analysis (MCA)

Cost-Benefit Analysis (CBA)

The Cost-Benefit Analysis is an evaluation method that gives an overview of the advantages and disadvantages of project alternatives or measures in terms of social welfare. These advantages and disadvantages are presented in the form of cost items and benefit items on a cost-benefit balance sheet. The items are expressed in terms of money (“monetised”) to enable the various project alternatives to be compared. The main question in a Cost Benefit Analysis is “Do the benefits outweigh the costs?”. The welfare effect is expressed in the balance of all costs and benefits. The costs and benefits of alternatives can also be compared to determine which alternative is preferable.

Cost-Effectiveness Analysis (CEA)

The aim of a Cost-Effectiveness Analysis is to determine with which measures or packages of measures (project alternative) an objective can be reached at the lowest cost possible (cost minimisation). The analysis method can also be used to determine which project alternative, given the maximum budget, that will contribute most to the achievement of the objective (effect maximisation). With a CEA, either the objective or the available amount of money is fixed.

Multi-Criteria Analysis (MCA)

A Multi-Criteria Analysis give a decision-maker the opportunity to weigh a wide range of different effects against each other in the decision-making process. MCA methods can be used to get large quantities of dissimilar information into a manageable form for decision-making. A MCA produces a “weighted sum” of the project’s effects. For each project alternative, a number of criteria are used to give a weighing to each of the effects considered. The weightings determine how significant an effect is in the project alternative’s overall score. Valuation criteria are not expressed exclusively in money. An assessment grade can be given to criteria for which a good monetary estimate is not possible. In a first step, all scores, both monetary and non-monetary rating grades, are normalized so that the best scoring option on a given criterion receives a 1, while other options receive a proportionately lower score. In a second step, weights are assigned to all criteria, by which the normalized scores are multiplied. By adding the results together, the various alternatives are ranked in order of preference based on overall scores. The crucial step in MCA is determining the weights of the criteria. Weights can be determined for example through expert judgment and/or stakeholder consultation.

Methods for valuation of effects

Several methods have been developed to identify and estimate the effects of investments, in terms of socio-economic costs and benefits. Some of these methods are described in more detail in other Coastal Wiki articles.

- The Travel Cost Method primarily measures the recreational value that visitors place on particular recreation areas (parks, beaches, woodland etc.). It is assumed that the costs in terms of time and transportation that an individual incurs in visiting a site reflect the person’s appreciation of that site. The basic principle is that people only visit an area if the expected benefits exceed the costs incurred. The costs incurred are then taken as an indicator of the benefits (recreational values). TCM is a useful method to assess recreational benefits. Travel costs are related to distance and can only capture part of the total value of nature (recreation). See Travel cost method.

- The Contingent Valuation Method (CVM) assumes that people have preferences in relation to all goods, and therefore also in relation to goods that are not available on an existing market. The aim of a CVM study is to reveal these hidden preferences by means of questionnaires. People are asked the maximum amount of money they are willing to pay (or willing to accept as compensation) for a hypothetical change of a good. It is assumed that this professed willingness would equate to real willingness if a real market for the good did exist. Only the Contingent Valuation Method can capture both use and non-use values. However, the surveys have to be carefully designed. See Contingent Valuation Method.

- The Hedonic Pricing Method relates differences in property prices (house and land prices) to variables in the surrounding environment. The basic principle is that property prices are affected to some extent by the characteristics of a particular environment effect. The environment effect can then be given a price tag based on house prices. An environment effect can be seen as positive (proximity to a recreational area, nice view) or negative (water pollution, risk of flooding). It may be to do with differences in time (time series data: prices in 1970 compared to prices in 2005 related to a change in the environment effect). It is also possible to analyse differences between areas with the same type of property but with one important difference in environment variable (cross-section data: the same type of housing in comparable environments with and without the environment effect). See Hedonic Evaluation Approach and Values of amenities in coastal zones.

- The Prevention Cost Method is based on the prevention expenditure incurred by households, companies or governments to mitigate or avoid particular environmental risks or effects. Examples include the cost of sound insulation (double-glazing, noise barriers) to prevent or reduce excessive noise, or the cost of dikes to prevent flooding. People will only incur this prevention expenditure if the expected usefulness of the expenditure is greater than the expected inconvenience created by the environment effect. Willingness to incur this expenditure is an indication of the minimum cost of the effect or of the minimum benefit of mitigation of the effect.

- The Production Factor Method rates changes in the productivity of natural or man-made systems as a result of a change in the environment. An example is the reduction in fish catch as a result of deterioration in water quality caused by a factory not cleaning its wastewater sufficiently before discharging it into the river. If the relationship between the water quality (dose) and the fish catch (response) is known, the value of deterioration in water quality can be calculated. The changes to the financial return of production (the fish catch) can be translated through the dose/response relationship into a counter value for the environment effect (the water quality).

- The Benefit (or Value) Transfer Method, estimates of the benefits of nature and the environment from earlier studies are taken as an indication of the economic value of the benefits of nature and the environment in a new, similar policy context. See Value Transfer.

- The Restoration Cost Method calculates the cost of measures required restoring or compensating for deterioration in or loss of nature and environment as a result of a project. This is also referred to as the Shadow Project Method. The method estimates the cost of specific measures designed to restore or compensate for deterioration in or loss of nature and environment.

- Bequest value measures the willingness of individuals to pay for maintaining or preserving an asset or resource that has no use now, so that it is available for future. See Non-use value: bequest value and existence value

- Existence value measure the willingness for individuals to pay for the sense of well being, of simply knowing that coastal zones are preserved.

References

- ↑ Boardman, A., Greenberg, D., Vining, A. and Weimer, D. 2018. Cost-Benefit Analysis – Concepts and Practice, Fourth edition, Cambridge University Press. https://students.aiu.edu/submissions/profiles/resources/onlineBook/E5V5H3_Cost-benefit%20analysis%20_%202018.pdf

- ↑ EU 2015. Guide to Cost-Benefit Analysis of Investment Projects Economic appraisal tool for Cohesion Policy 2014-2020. European Commission DG for Regional and Urban policy https://ec.europa.eu/regional_policy/sources/studies/cba_guide.pdf

See also

Internal Links

- Total Economic Value

- Travel cost method

- Contingent Valuation Method

- Hedonic Evaluation Approach

- Value Transfer

- Economic Value

- Economic valuation of goods and services of the UK coastal and marine ecosystem

- Non-use value: bequest value and existence value

- Values of amenities in coastal zones

- Multifunctionality and Valuation in coastal zones: concepts, approaches, tools and case studies

- Multifunctionality and Valuation in coastal zones: introduction

Please note that others may also have edited the contents of this article.

|